"PatBateman" (PatBateman)

"PatBateman" (PatBateman)

12/29/2013 at 15:19 • Filed to: Movies

0

0

5

5

"PatBateman" (PatBateman)

"PatBateman" (PatBateman)

12/29/2013 at 15:19 • Filed to: Movies |  0 0

|  5 5 |

So last night, my wife and I went to the movies. The theater was in a nice part of town in Austin, so many nice cars were in the parking garage. But once the flick started, the car porn (and the laughs) began.

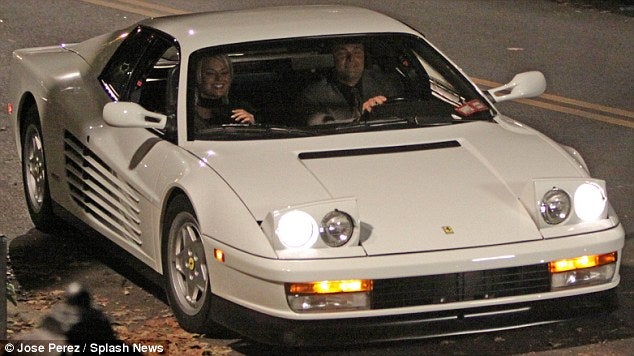

First scene was a Ferrari Testarossa. Red... No, white (it literally changed colors magically). Awesome!! Then the actual narrated story began. And I was dying laughing. Not because it was a particularly funny movie, but because I'm a financial advisor, and every stockbroker in the movie was an exaggerated stereotype. All of them. Apparently, we all do cocaine, have relations with hookers, masturbate twice per day, and party all night. I, nor any of my peers in my office, have gotten this memo. I'm doing my job wrong, it seems.

The part (minor spoiler) that set me apart from the rest of the viewing audience was when Jordan Belfort (AKA The Wolf) was proudly marching up to his office after passing his Series 7 (stockbroker license) and the screen showed the date: October 19, 1987. I began laughing uncontrollably while everyone looked at me wondering what was so funny. That date, in my industry, is one that lives in infamy and is a reason why asset allocation is so damned important: BLACK MONDAY. The day that the stock market plunged over 22% during trading. The joke was realized within 10 seconds, but I got the jump start on it.

Other vehicles shown were a delight to any autophile: Countach, Rolls Royce, Range Rover, MB SL... But even with all of the great rides, I couldn't get over the fact that whoever sees this movie will immediately think that this is how the financial world works. A bunch of drugged-out whore mongers living a life of excess and trying to steal people's money. It's not how it is, but I see running into this problem in the near future. I'll laugh a bit when I see it happen, but know that a Hollywood portrayal of my line of work will set me back when I talk to someone about their investments.

Final verdict: great movie, lots of cool cars, but keep in mind that it's a movie. I don't do blow off a hooker's butt.

joey-taps

> PatBateman

joey-taps

> PatBateman

12/29/2013 at 15:27 |

|

were you the only one laughing?

PatBateman

> joey-taps

PatBateman

> joey-taps

12/29/2013 at 15:32 |

|

The vast majority of the time, yes. In a few scenes, I was mentally keeping track of the FINRA violations while cackling at the scenario. The dark jokes were humorous, but I got more of a kick out of them.

Chuck 2(O=[][]=O)2

> PatBateman

Chuck 2(O=[][]=O)2

> PatBateman

12/29/2013 at 15:41 |

|

I'm currently in college studying economics along with accounting. I am also on the exec board of my school's investment group (SIG), where we manage about $200k of the school's money. My question is, what exactly is your job, do you enjoy it, do you have any advice, etc.? I ended up asking a gentleman yesterday about his Ferrari 365 and found out he was an accountant, so I figured I would just start asking other Oppos for insight and advice.

Bob Loblaw Made Me Make a Phoney Phone Call to Edward Rooney

> PatBateman

Bob Loblaw Made Me Make a Phoney Phone Call to Edward Rooney

> PatBateman

12/29/2013 at 15:59 |

|

I thought the actual mechanics of the story as it regarded finance was pretty laughable as well. The real Jordan Belfort was a seriously heinous criminal who made his money by issuing IPOs for companies that didn't really exist. Obviously, the movie was inspired by him but not directly about him, but the securities law violations in question in the movie were, while sleazy and illegal, not really all that criminally condemnable in the grand scheme of perpetrated frauds (and in comparison to the real Belfort's crimes). Some insider trading here, yes, and some aggro sales tactics there, but in the end it seems like the money laundering counts were the only legitimately serious charges he was facing.

PatBateman

> Chuck 2(O=[][]=O)2

PatBateman

> Chuck 2(O=[][]=O)2

12/29/2013 at 16:12 |

|

I work for a large wirehouse brokerage, which means that my company, that is world-renowned in the investment community, is NOT the kind of firm that just slings stocks. What I do, however, is bring solutions, simple and complex, to both perceived and unperceived problems. I also use my company's research and forecasting department to pick and choose the investments that are appropriate for each client.

That sounds pretty simple, but it really isn't. The sheer amount of different investment choices, programs, funds, separately managed accounts, trusts, insurance policies/annuities, and retirement plans blow most people's minds. The financial planning software that I use is NOT like any other simple programs available to the general public at do-it-yourself brokerages or investment websites.

Also, I have to figure out what is an appropriate investment and wealth preservation plan for each one of my clients. While clients in the past used to be primarily concerned with beating the returns of the Dow Jones every year, the name of the game now is to align the client's risk tolerance to their investment portfolio and also to their financial goals.

I have to know how my clients are spending their money, how they want to retire (which is many times completely irrational), what investments are appropriate for them, and how to maximize their risk-adjusted returns without handing them a huge tax bill at the end of the year. And yes, FINRA and the SEC are constantly looking over my shoulder at EVERY TRADE.

In a nutshell, that's what I do.